Sign up for MarketBeat All Access to gain access to MarketBeat's full suite of research tools:

ESCO Technologies Inc. (NYSE:ESE - Get Rating) saw a significant increase in short interest in December. As of December 15th, there was short interest totalling 257,300 shares, an increase of 11.5% from the November 30th total of 230,700 shares. Based on an average daily volume of 79,600 shares, the days-to-cover ratio is currently 3.2 days. Currently, 1.0% of the company's stock are short sold. ESCO Technologies Stock Down 1.0 % Pall Coreless Filter Elements

Shares of NYSE:ESE traded down $0.89 during trading on Monday, hitting $87.54. The company's stock had a trading volume of 2,632 shares, compared to its average volume of 98,991. The company has a debt-to-equity ratio of 0.13, a quick ratio of 1.29 and a current ratio of 1.80. ESCO Technologies has a fifty-two week low of $60.03 and a fifty-two week high of $96.69. The stock's 50-day moving average price is $89.22 and its two-hundred day moving average price is $80.74. The company has a market capitalization of $2.27 billion, a PE ratio of 27.70 and a beta of 1.08.

ESCO Technologies (NYSE:ESE - Get Rating) last released its quarterly earnings results on Thursday, November 17th. The scientific and technical instruments company reported $1.21 EPS for the quarter, topping the consensus estimate of $1.15 by $0.06. ESCO Technologies had a return on equity of 8.13% and a net margin of 9.60%. The business had revenue of $256.50 million for the quarter. As a group, sell-side analysts expect that ESCO Technologies will post 3.51 EPS for the current year. ESCO Technologies Dividend Announcement

The company also recently disclosed a quarterly dividend, which will be paid on Friday, January 20th. Investors of record on Thursday, January 5th will be issued a $0.08 dividend. This represents a $0.32 annualized dividend and a yield of 0.37%. The ex-dividend date is Wednesday, January 4th. ESCO Technologies's dividend payout ratio is currently 10.13%. Institutional Trading of ESCO Technologies

Several hedge funds and other institutional investors have recently bought and sold shares of the company. Amalgamated Bank increased its holdings in ESCO Technologies by 1.1% in the third quarter. Amalgamated Bank now owns 11,800 shares of the scientific and technical instruments company's stock valued at $867,000 after buying an additional 126 shares during the last quarter. Mitsubishi UFJ Kokusai Asset Management Co. Ltd. increased its holdings in ESCO Technologies by 1.8% in the third quarter. Mitsubishi UFJ Kokusai Asset Management Co. Ltd. now owns 10,100 shares of the scientific and technical instruments company's stock valued at $742,000 after buying an additional 181 shares during the last quarter. Signaturefd LLC increased its holdings in ESCO Technologies by 31.1% in the third quarter. Signaturefd LLC now owns 835 shares of the scientific and technical instruments company's stock valued at $61,000 after buying an additional 198 shares during the last quarter. Captrust Financial Advisors increased its holdings in ESCO Technologies by 0.9% in the second quarter. Captrust Financial Advisors now owns 21,891 shares of the scientific and technical instruments company's stock valued at $1,497,000 after buying an additional 206 shares during the last quarter. Finally, Texas Permanent School Fund increased its holdings in ESCO Technologies by 1.5% in the second quarter. Texas Permanent School Fund now owns 18,703 shares of the scientific and technical instruments company's stock valued at $1,279,000 after buying an additional 275 shares during the last quarter. 93.96% of the stock is owned by institutional investors. Analysts Set New Price Targets

A number of brokerages have commented on ESE. Stephens boosted their price objective on ESCO Technologies from $100.00 to $110.00 and gave the stock an "overweight" rating in a research note on Monday, November 21st. StockNews.com upgraded ESCO Technologies from a "hold" rating to a "buy" rating in a research note on Monday, November 21st.About ESCO Technologies (Get Rating)

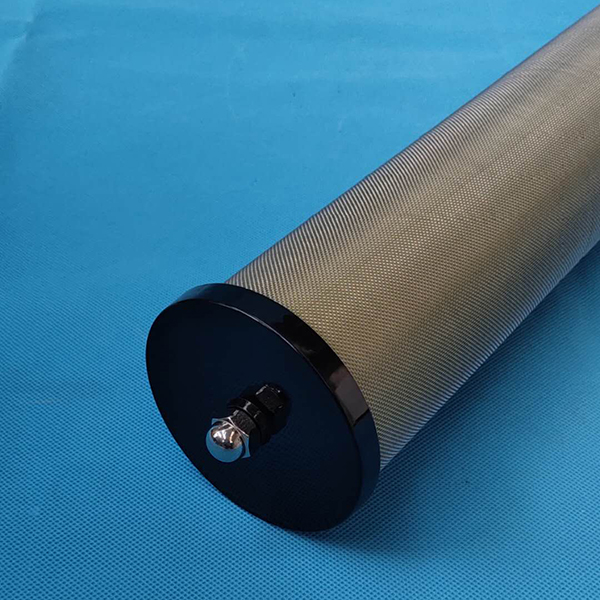

ESCO Technologies Inc produces and supplies engineered products and systems for industrial and commercial markets worldwide. It operates through Aerospace & Defense, Utility Solutions Group, and RF Shielding and Test segments. The Aerospace & Defense segment designs and manufactures filtration products, including hydraulic filter elements and fluid control devices used in commercial aerospace applications; filter mechanisms used in micro-propulsion devices for satellites; and custom designed filters for manned aircraft and submarines.Further ReadingGet a free copy of the StockNews.com research report on ESCO Technologies (ESE)MarketBeat: Week in Review 12/26 – 12/30The Dogs Of Tech: It’s Time For A Bite Of These StocksDoes This Acquisition Make Microsoft a Bear Market Buy?Should You Warm up to Generac Stock for the Winter? Is Kintara Therapeutics A Hidden Gem?

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider ESCO Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ESCO Technologies wasn't on the list.

While ESCO Technologies currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Enter your email address below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Sign up for MarketBeat All Access to gain access to MarketBeat's full suite of research tools:

View the latest news, buy/sell ratings, SEC filings and insider transactions for your stocks. Compare your portfolio performance to leading indices and get personalized stock ideas based on your portfolio.

Get daily stock ideas from top-performing Wall Street analysts. Get short term trading ideas from the MarketBeat Idea Engine. View which stocks are hot on social media with MarketBeat's trending stocks report.

Identify stocks that meet your criteria using seven unique stock screeners. See what's happening in the market right now with MarketBeat's real-time news feed. Export data to Excel for your own analysis.

326 E 8th St #105, Sioux Falls, SD 57103 contact@marketbeat.com (844) 978-6257

© American Consumer News, LLC dba MarketBeat® 2010-2023. All rights reserved.

Filter © 2023 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions. Information is provided 'as-is' and solely for informational purposes, not for trading purposes or advice, and is delayed. To see all exchange delays and terms of use please see Barchart's disclaimer.